You’ve decided that having a vision insurance plan is a smart move for your eye health. Congratulations! Now, time to pick your vision plan.

Choosing the right vision insurance can make a big difference in both the quality and cost of your eye care. With so many options available, it can be hard to navigate the details of each plan. Whether you need coverage for routine eye exams, glasses, or even advanced procedures like LASIK, it’s crucial to ask the right questions to make sure your vision care needs are met. The risks of not having vision insurance are too high!

We’ve put together a guide with answers to seven important questions you should ask when shopping for the best vision insurance.

1) What kinds of vision insurance plans are available?

There are generally two types of vision insurance plans: standalone plans and vision coverage through health insurance.

-

Standalone Vision Insurance Plans: These types of vision plans are purchased separately from your regular health insurance and typically cover a range of eye care needs. Standalone vision insurance plans often include coverage for annual eye exams, glasses, contact lenses, and sometimes discounts on LASIK surgery. Standalone plans can either be basic, with coverage focused on preventive care (like eye exams and basic frames), or more full-service coverage, including lens enhancements and/or larger frame allowance.

-

Vision Coverage Through Health Insurance: Many health insurance policies, especially employer-sponsored plans, include basic vision coverage as an add on. However, these plans may have more limited benefits compared to standalone vision insurance. Vision coverage through health insurance is often less customizable and may focus on routine eye exams and glasses, with limited options for contacts or other vision-related procedures.

When choosing a vision insurance plan, consider whether a standalone vision insurance policy or the vision benefits included in your health insurance plan offer the best coverage for your vision and eye needs. Standalone vision insurance may offer more specialized care and coverage options, while vision coverage through health insurance may be cheaper and offer fewer choices.

2) What do vision insurance plans cover?

The coverage offered by vision insurance plans can vary widely, so it’s essential to understand exactly what is included before committing to a plan. Most eye insurance policies cover (or partially cover) the following vision services:

-

Annual Eye Exams: A routine eye exam typically includes a vision test, eye health check, and screening for common conditions like glaucoma or cataracts. This is usually covered fully under most plans once a year with a copay. Remember: Regular eye exams are important for vision health and to support overall wellness.

-

Eyeglasses or Contact Lenses: Most plans offer coverage for glasses or contacts, but the amount may vary. Coverage often includes a portion of the cost of frames, lenses, and contact lenses, but there may be limits on the type of lenses or frames you can choose.

-

Discounts on LASIK: While not always covered, some vision insurance plans offer discounts or promotional rates on LASIK (Laser-Assisted in Situ Keratomileusis) surgery. If you’re considering LASIK, it’s worth checking whether your plan provides these discounts.

-

Additional Vision Services: Some vision plans may also offer coverage for special lenses (like bifocals or progressives), repairs for eyeglasses, or specialized care like vision therapy. It’s important to verify which services are covered and whether there are any exclusions or limitations.

Understanding what is covered—and what is not—will help you avoid unexpected out-of-pocket expenses and ensure you get the most value from your plan.

3) Can insurance cover LASIK?

LASIK is a popular surgical procedure for correcting vision issues like nearsightedness, farsightedness, and astigmatism. Although LASIK can be life-changing for many people, it can also be expensive, with LASIK costs ranging from $1,499 to $2,499 per eye.

Vision insurance typically does not fully cover LASIK surgery because it is considered an elective procedure, and not medically necessary. However, some plans offer discounts on LASIK or may cover a portion of the cost of the procedure. These discounts may vary by plan provider and discounts typically range from 10% to 50%.

If LASIK is a priority for you, be sure to ask whether your eye insurance plan includes any LASIK discounts or partnerships with LASIK surgery centers. Even if LASIK isn’t covered under your insurance, plan-associated discounts can make LASIK more affordable.

4) Is my eye doctor in my plan’s network?

If you already have a preferred eye care provider (optometrist or ophthalmologist), one of the most important factors to consider when choosing vision insurance is whether they are in the plan’s network. Vision insurance plans, like health insurance plans, typically have a network of preferred providers. If you see a doctor outside the network, you may face higher out-of-pocket costs or, in some cases, may not get coverage for your care.

To ensure you can continue seeing your current eye care provider without paying more than expected, ask these questions before deciding on a plan:

-

Is my eye doctor part of the network?

-

What happens if I want to see an out-of-network provider? (Will I still be reimbursed, and if so, at what rate?)

-

Can I change eye care providers later if I’m not happy with my doctor?

If you have a long-standing relationship with a specific eye doctor, it’s worth confirming that they are in network before enrolling in a vision insurance plan.

5) What are the copays for my vision plan?

A copay is a fixed amount you pay for services, such as an eye exam, glasses, or contact lenses, under your vision insurance plan. Depending on your plan policy, your copay can vary for different services. For example, you may pay a $10 copay for an eye exam but a $30 copay for a new pair of glasses. Some plans may offer discounts on services, rather than a fixed copay.

It’s important to ask about copay amounts for various services, as they can significantly impact your overall costs. Some vision plans may have low copays for routine exams but higher copays for more expensive items like specialty lenses.

Before committing to a plan, make sure you understand the copay structure and whether it fits with your budget and expected eye care needs.

6) Does my vision insurance plan have a deductible?

A deductible is the amount you must pay out of pocket before your vision insurance starts covering expenses. For example, if your plan has a $100 deductible, you would pay the first $100 of any eligible vision-related expenses, and after that your vision insurance would begin to cover the remaining expenses.

Some vision plans have a low or even zero-dollar deductible, especially for basic coverage, while others may have higher deductibles for more full service plans. It’s important to understand how your deductible works and how much you will need to pay before receiving benefits.

Keep in mind that deductibles for vision insurance are nearly always separate from your medical insurance deductible. Understanding this upfront can help you manage your expectations and avoid surprises when it’s time to pay for services.

7) Does vision insurance cover contact lenses?

If you wear contact lenses, it’s essential to confirm whether your vision insurance plan covers them. In many cases, vision insurance plans will cover the cost of contact lenses, but the coverage may be less than that for eyeglasses.

Some things to consider about insurance coverage for contacts:

-

Coverage Limit: Many plans cover the cost of one pair of contact lenses per year, but this may be subject to a spending limit (for example, $150 per year). If you choose a more expensive brand or type of contact lenses, you may need to pay the difference out of pocket.

-

Contact Lens Exam: In addition to paying for the lenses themselves, there may be additional charges for a contact lens fitting exam, which some insurance plans cover, and others do not.

-

Type of Contacts: Not all contact lenses are created equal. If you wear specialty lenses (like toric lenses for astigmatism or colored lenses), your vision insurance may not cover these, or there may be limits on how much your plan will cover.

If you rely on contact lenses, make sure to ask about the specifics of your coverage to ensure it meets your needs.

Conclusion

Choosing a vision insurance plan that meets your needs involves considering a variety of factors, from the types of plans available to specific coverage details like copays, deductibles, and benefits for contacts or LASIK.

By asking the right questions and understanding what your plan covers (as well as potential savings from the plan’s benefits), you can make an informed decision that ensures your eye care needs are met without breaking the bank.

Don’t be afraid to shop around, compare plans, and make sure your new plan has a network of providers that works for you. You can find a large nationwide network with VSP® Individual Vision Plans. When you are ready to enroll, choosing a vision plan takes just a few minutes with the VSP Individual Vision Plan Selector.

Your vision is worth the investment, and the right insurance can help you take care of it.

Information received through VSP Individual Vision Plans’ social media channels is for informational purposes only and does not constitute medical advice, medical recommendations, diagnosis, or treatment. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition.

Reviewed by Dr. Valerie Sheety-Pilon:

Dr. Valerie Sheety-Pilon is Vice President of Clinical and Medical Affairs at VSP Vison Care where she helps drive strategic initiatives aimed at raising awareness about vision, eye health and its connection to overall wellness, while providing insight into medical advancements that seek to benefit patient care. She also provides oversight of VSP programs to address gaps in care for some of the most high-risk populations, including those living with diabetes.

With more than two decades of experience as a Doctor of Optometry, Dr. Sheety-Pilon has dedicated much of her time to clinical research across numerous ophthalmic subspecialties and has an established history of helping patients through novel therapeutic agents and clinical adoption of transformative technology in the areas of digital health, pharmaceuticals, and medical devices.

Prior to joining VSP Vision in 2019, Dr. Sheety-Pilon served as Adjunct Clinical Professor at Illinois College of Optometry, held various executive positions within the eye health industry, and has extensive experience managing and practicing within an ophthalmology and optometry practice.

Your vision. Your way.

Not covered for vision? Get an individual plan, customized for you – including where you want to use it: at the doctor, in a retail location, or even online.

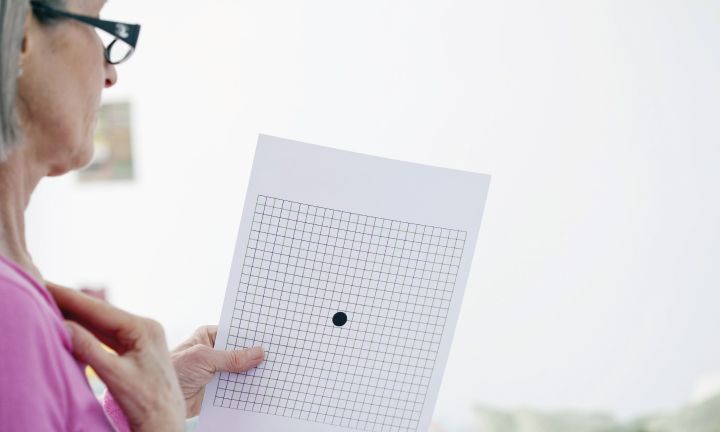

Understanding Macular Degeneration

Macular degeneration is an eye disorder that results in damaged sharp and central vision. According to the American Optometric Association, it affec...

Glasses: Frequently Asked Questions and Answers

The Vision Council estimates that there are 166.5 million adults in the United States who wear eyeglasses, and we are here to answer the frequently ...

VSP Vision Insurance Questions and Answers

What are frame allowances and copays? What does my vision insurance cover? Vision insurance can seem confusing to some people. Here is a set of the ...